ACAMS CAMS Übungsprüfungen

Zuletzt aktualisiert am 09.09.2025- Prüfungscode: CAMS

- Prüfungsname: Certified Anti-Money Laundering Specialist

- Zertifizierungsanbieter: ACAMS

- Zuletzt aktualisiert am: 09.09.2025

In its paper. Customer Due Diligence for Banks, the Basel Committee on Banking Supervision identified which risks on banking institutions as a result of an inadequate KYC program?

- A . Outsourcing, legal, concentration, reputational

- B . Security, information, local, operational

- C . Legal, reputational, operational, concentration

- D . Credit, operational, market, concentration

A client who owns a swimming pool company requests to open 19 accounts at a bank, each with a debit card for its swimming pool technicians. When asked about the purpose of each account, the client explains that each technician needs a separate checking account to purchase pool chemicals.

Which available source could be used in the bank’s internal investigation on this client’s activities?

- A . Client’s credit bureau report

- B . Local law enforcement investigation report

- C . Interview swimming pool technicians and chemical suppliers

- D . Internet search showing how such business are typically operated

An international bank is investigating a payment requested by a correspondent banking partner. The payment originated from a corporation located in Hong Kong, and the final beneficiary is an individual in New York. The transaction triggered an alert in the bank’s automated transaction monitoring system.

Which steps should the bank take first to address the alert? (Select Three.)

- A . Call the receiving individual to review identity verification documents.

- B . Confirm that neither the beneficiary nor the originator are sanctioned parties.

- C . Request supporting documents, including invoices and contracts, to confirm the purpose of the payment.

- D . Check for negative news in public sources on the sender and receiver.

- E . Send a 314(b) request to the corporation’s bank in Hong Kong.

An international bank is investigating a payment requested by a correspondent banking partner. The payment originated from a corporation located in Hong Kong, and the final beneficiary is an individual in New York. The transaction triggered an alert in the bank’s automated transaction monitoring system.

Which steps should the bank take first to address the alert? (Select Three.)

- A . Call the receiving individual to review identity verification documents.

- B . Confirm that neither the beneficiary nor the originator are sanctioned parties.

- C . Request supporting documents, including invoices and contracts, to confirm the purpose of the payment.

- D . Check for negative news in public sources on the sender and receiver.

- E . Send a 314(b) request to the corporation’s bank in Hong Kong.

Potential indicators of money laundering associated with Trust and Company Service Providers include: (Select Two.)

- A . use of legal persons in jurisdictions with strict secrecy laws.

- B . structuring cash deposits into third party accounts.

- C . multi-jurisdictional wire transfers with no legal purpose.

- D . generation of rental income to legitimize illicit funds.

- E . frequent deposits to or withdrawals from bank accounts.

A compliance officer of a financial institution is reviewing a payment for sanctions compliance

between two parties in Europe and Asia. The payment is in Euros and involves the provision of services to a company located in a jurisdiction subject to Office of Foreign Assets Control secondary sanctions.

Which factor is most important in determining the compliance officer’s response?

- A . Asset freezes only prohibit US companies from engaging in certain activities with counterparts from a sanctioned jurisdiction.

- B . A one-off commercial transaction conducted between parties in Europe and Asia is not subject to secondary sanctions.

- C . The threat of US sanctions against foreign individuals and entities continues to exist despite the absence of a US nexus.

- D . Secondary sanctions only target specific sectors of the economy such as the banking and finance sectors.

A compliance officer of a financial institution is reviewing a payment for sanctions compliance

between two parties in Europe and Asia. The payment is in Euros and involves the provision of services to a company located in a jurisdiction subject to Office of Foreign Assets Control secondary sanctions.

Which factor is most important in determining the compliance officer’s response?

- A . Asset freezes only prohibit US companies from engaging in certain activities with counterparts from a sanctioned jurisdiction.

- B . A one-off commercial transaction conducted between parties in Europe and Asia is not subject to secondary sanctions.

- C . The threat of US sanctions against foreign individuals and entities continues to exist despite the absence of a US nexus.

- D . Secondary sanctions only target specific sectors of the economy such as the banking and finance sectors.

FATF recommends the incorporation of some measures in customer due diligence (CDD) programs including:

- A . conducting the risk assessment of products and services.

- B . conducting ongoing due diligence on the business relationship and monitoring of transactions.

- C . identifying the products and services and their suitability to customers.

- D . identifying the number of beneficial owners without the verification of their true identity.

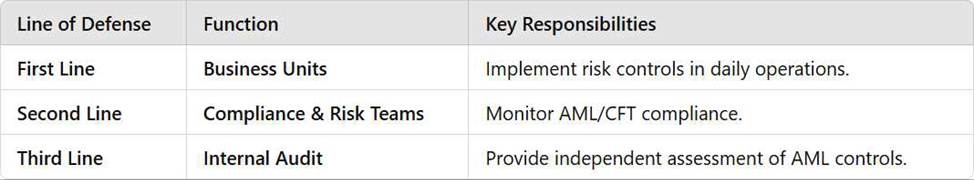

As emphasized in the Basel Committee guidance for "Sound Management of Risks Related to Money Laundering and Financing of Terrorism", the third line of defense (audit function) should:

- A . Conduct AML audits no less often than every 12 months for consistency in annual reporting.

- B . Report to the audit committee of the board of directors to maintain independence.

- C . Remain independent from expressing opinions on the sufficiency of remediation or action plans to address findings and recommendations.

- D . Be involved in the day-to-day operations of the AML program to immediately prevent control failures.

Which risk factors are considered when assessing risk rating of customers? (Select Three.)

- A . Customer risk

- B . Geographic risk

- C . Product risk

- D . Credit risk

- E . Fraud risk

- F . Employment risk